do pastors file taxes

In fact supporting the needs of pastors and the work of the local church is one of the main purposes of tithing. The most recent user fee can.

How Pastors Pay Federal Taxes The Pastor S Wallet

Heres how these taxes are handled for members of the clergy.

. Although churches are not required by law to file an application for exemption if they choose to do so voluntarily theyre required to pay the fee for determination. When you file your taxes at the end of the year everything you owe gets lumped into one tax bill regardless of whether it is for income tax self-employment taxes or something else. Call 434-977-4000 or Email.

According to the updated Living Wage Calculator a liveable wage in the US. What taxes do I owe. Note that we did not include the tax-free amount of 1500 accountable reimbursements It would not be reported anywhere on the W-2.

When you Rebuild Data youll receive a message to back up. This blog will help answer any questions you may have. This is a common and costly mistake.

If you receive a message Your data has lost integrity the file is damaged. We do NOT need a name just information. Community Risk.

Most coaches use this training to minister to people in their church or to start their own coaching business. Just continue to Rebuild Data to correct the problem. Youll be able to offer hope to everyonefrom the financially secure to the financially distressed.

If QuickBooks detected no problems theres no further action needed. Otherwise the application will be returned to the submitter. Ministers pastors and other members of the clergy are required to pay Federal Income tax on their salary.

Plus being outrageously generous is a. Home values have been soaring but the amount of home sale profit you can shelter from taxes has not. The fee must be submitted with Form 1023.

If you want to do options 2 or 3 youll have to make sure that your church is willing to cooperate. The 250000500000 exemption hasnt changed since it was created in. Giving encourages a grateful and generous spirit and can help steer us away from being greedy or loving money too much.

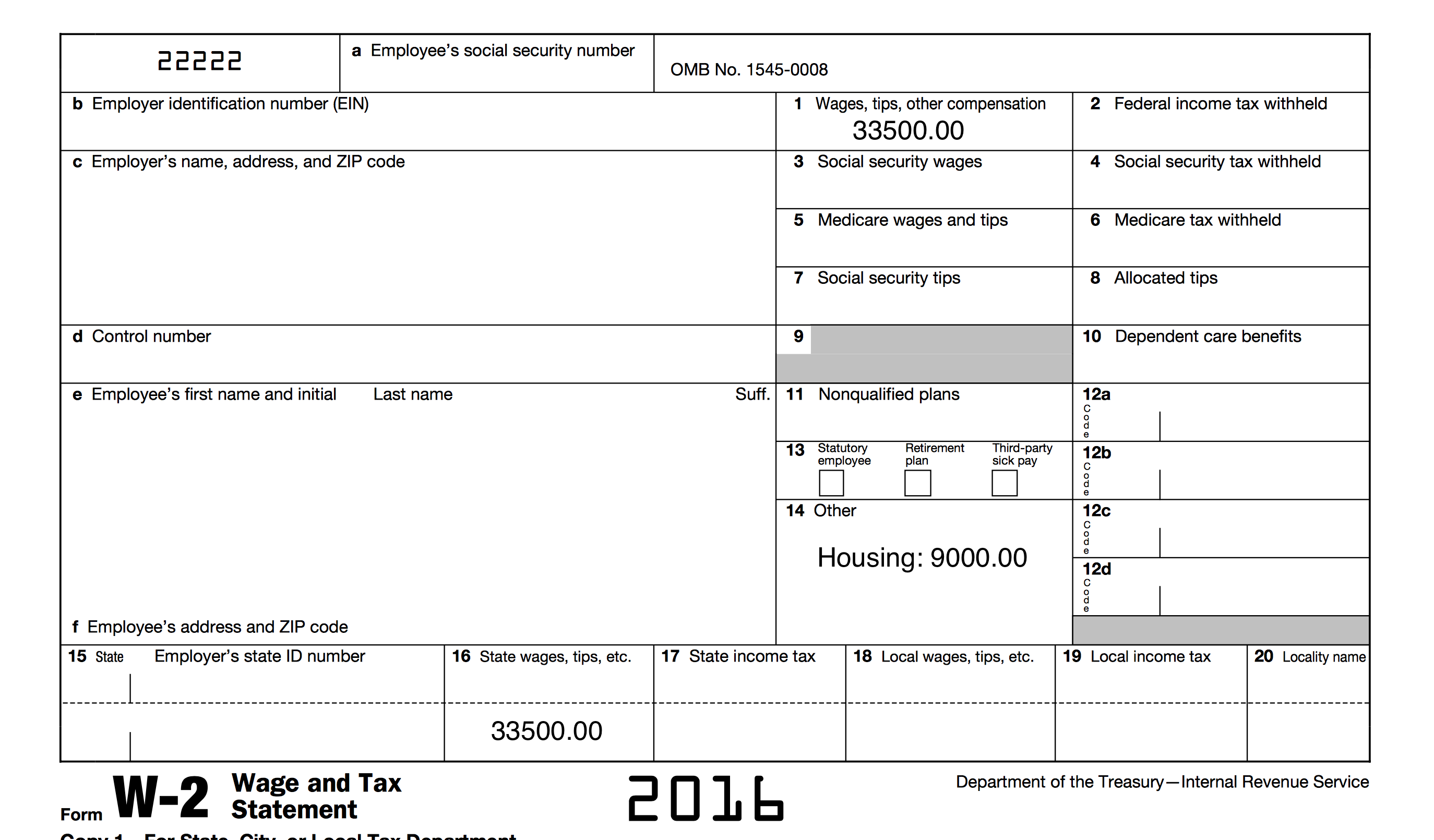

You can see this in action through our work with our Community Advisory Teams and the local Pastors Council where district commanders meet with community members to review. Tithing helps your local church actively be the church by helping others. Fill out the information boxes a b c e and f.

Include his base salary of 25000 his unaccountable car allowance of 2500 and the 6000 social security tax allowance in Box 1. So if you owe 5000 in self-employment taxes and your church withheld an extra 5000 in federal income taxes then it all evens out in the end and you dont. What is H1b Approved After October 1.

Example of pastors W-2 instructions. About 70 do both ministry and business but how you use the training is up to you. Based on data from 2021 is 2416 per hour before taxes for a family of four in which both adults are working.

And as you file your tax return this year make sure that anyone who is helping you understands ministerial taxes because not all paid preparers do. Go to Utilities then choose Verify Data. How do people use the training.

They may designate a portion of their earnings as housing allowance on which they do not pay federal income tax. FILE - People gather to protest against HB1041 a bill to ban transgender women and girls from participating in school sports that match their gender identity during a rally at the Statehouse in. Heres what youll need to do.

There you have it the three different options that pastors have for paying their taxes. As the deadline to file your taxes this year rapidly approaches many members and non-members alike have questions on how Medi-Share works and whether monthly shares or annual household portions in our healthcare sharing ministry are tax-deductible.

How To Feel When A Pastor Asks You For Money Quora

How Much Should You Pay Your Pastor The Pastor S Soul

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

Tax Preparation For Pastors And Clergy Tax Preparation Our Services

Dual Tax Status What Does It Mean For Your Pastor American Church Group Texas

The Pastor S Guide To Taxes And The Irs Ascension Cpa

How To Set The Pastor S Salary And Benefits Leaders Church

Clergy Tax Guide Howstuffworks

Quickbooks For Houses Of Worship Understanding Pastor Payroll Youtube

The Pastor S Tax Man Clergy And Minister Taxes Simplified

Video Q A Do Pastors Really Have To Pay 15 3 For Seca The Pastor S Wallet

How Do Church Pastors Get Paid House Of Prayer

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Online Taxes File Taxes Online

If They Re So Interested In Getting Into Politics And Telling Us How To Live Our Lives Let Them Pay Taxes Like The Rest Of Us Fix It Jesus Pastor Humor

Pastor Appreciation Day Are Your Love Offerings Taxable Income To Your Pastors Stanfield O Dell Tulsa Cpa Firm

What Is Customer Retention Customer Retention Customer Retention Ideas Customer Loyalty